March 5, 2025 | Daily JAM |

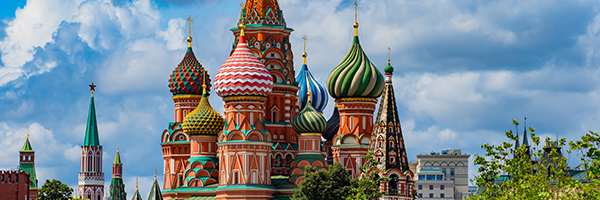

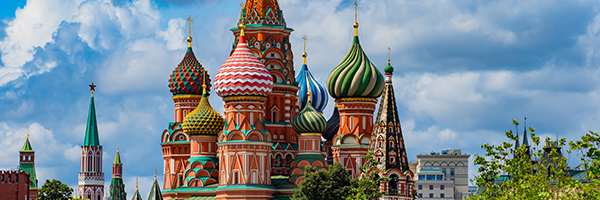

Russia’s oil-tax revenue in February slumped by almost a quarter year-on-year, suggesting producers have reined in output to meet the country’s OPEC+ quota.

January 20, 2025 | Daily JAM, Morning Briefing, Notes You Need, Perfect Five-ETFs, Videos |

Oil slid as U..S President Donald Trump promised to boost U.S. crude production. Brent crude retreated almost 1% to near $80 a barrel.

January 14, 2025 | Daily JAM, DVN, Mid Term, Morning Briefing, XLE |

Global oil markets will face a widening glut in 2026 as OPEC brings back production and output from the United States, Canada and Guyana continues to grow, the U.S. Energy Information Agency said today, Tuesday, January 14. Today’s forecast was the agency’s first for 2026. World oil markets are expected to average a surplus of 800,000 barrels a day in 2026, the Energy Information Administration. That’s more than twice as large as the 300,000 barrel a day surplus the agency projects for 2025.

December 17, 2024 | Daily JAM, Morning Briefing |

Canada is looking at imposing taxes on major commodities it exports to the United States-—including uranium, oil and potash—if the incoming Trump Administration carries out a threat to impose 25% tariffs on Canadian exports.

December 5, 2024 | Daily JAM, Morning Briefing |

Oil edged lower–West Texas Intermediate closed down 0.06% and Brent ended 0.08% lower–after OPEC+ announced plans to defer supply increases for three months, but still add barrels starting in April to a market that’s expected to be oversupplied. The Organization of the Petroleum Exporting Countries and its allies agreed to delay their planned output hike.

December 4, 2024 | Daily JAM, Morning Briefing |

The forecasts don’t totally agree on the date but they do agree on the trend: Because China’s sales of electric vehicles and hybrids accounted for more than half of retail passenger vehicle sales in the four months from July, the country’s demand for gasoline is near a peak. And unlike in the U.S. and Europe where peaks in consumption were followed by long plateaus, the drop in demand in the world’s top crude importer is expected to be more pronounced. Brokerage CITIC Futures sees Chinese gasoline consumption dropping by 4% to 5% a year through 2030. The

International Energy Agency says demand peaked in 2024 and forecasts a 2.3% decline in 2025.

October 7, 2024 | Daily JAM, Morning Briefing |

It’s not surprising that stocks fell Monday, October 7. But it is surprising that they fell so little. The Standard & Poor’s 500 was off 0.96% on the day. The NASDAQ Composite dropped 1.18%. Wall Street’s favorite volatility gauge–the VIX–jumped to “just” a two-month high. Look at the negatives arrayed against stocks

October 2, 2024 | Daily JAM, Morning Briefing, Short Term |

What’s amazing to me right now is how complacent Wall Street is about the prospects for a wider regional war in the Middle East. Which could include an attack by Israel on Iran’s nuclear facilities.On a day when Israel vowed to retaliate against a barrage from Iran that rained down missiles on Israel’s Iron Dome defense, West Texas Intermediate oil rose by just 0.39% to $70.10 a barrel. International benchmark Brent crude was ahead just 1.43% to 74.61.

April 12, 2024 | Daily JAM, Morning Briefing, Short Term |

West Texas Intermediate rose to its October 2023 highs, before pulling back, on fears that an Iranian retaliation for an Israeli attack on an Iranian consulate would lead to a wider war in the Middle East. International benchmark Brent crude surged as much as 2.7% to top $92 a barrel before retreating to close at $90.26 a barrel, up 0.58% on the day. West Texas Intermediate, the U.S. benchmark, is now up 19% in 2024. Bloomberg reports that Western intelligence assessments are looking for an Iranian attack in the next 48 hours. No one wanted to hold U.S. equities ahead of the weekend.

December 19, 2023 | Daily JAM |

The world’s No. 2 oil producer, Saudi Arabia, wants to cut oil production to raise oil prices. And has even actually curtailed production to meet that goal. The world’s No 3 oil producer, Russia, wants (others mostly) to cut oil production to raise prices. And has even promised to cut its own production. (We’ll believe that when we see it.) But none of that matters because the world’s No. 1 oil producer, the United States, has put its foot to the accelerator and is producing at record volumes.

November 30, 2023 | Daily JAM |

OPEC+ agreed to a surprise new oil supply cut of about 900,000 barrels a day at today’s meeting. But oil prices fell anyway. Turns out that nobody believes that the organization will deliver on its promises. Members including Russia, the United Arab Emirates, Kuwait and Iraq pledged the extra reductions after an online meeting, OPEC said. And Saudi Arabia promised to continue its unilateral 1 million barrel-a-day cut through the first quarter. But, critically, the cuts are voluntary.

November 8, 2023 | Daily JAM |

To subscribe to JAM you need to fill in some details below including, ahem, some info on how you'll pay us. A subscription is $199 (although if you're subscribing with one of our special offers it will be lower) for a year for ongoing and continuing access to the...