April 17, 2022 | Daily JAM, Morning Briefing, Short Term |

U.S. benchmark West Texas Intermediate crude for May delivery climbed 1% to $108.01 a barrel at 10:09 a.m. Monday in Singapore. International benchmark Brent crude for June delivery gained 1.1% to $112.97 a barrel on the ICE Futures Europe exchange. Two Libyan ports have been forced to stop loading oil

April 7, 2022 | Daily JAM, Videos |

We’ve had a pretty good dip over the last few days in oil prices. I think that comes from a trading pullback from a quick run-up in prices, as well as optimism that the war in Ukraine will not last as long as people had thought. The oil stocks I added to my portfolios in January have done quite well. In this video, I look at a few of them: ConocoPhillips (COP), Pioneer (PXD), Cheniere (LNG), Equinor (EQNR), and the Energy Sector SPDR (XLE). I think many of these are set to continue rising as we see continued gains in raw material prices; plus, it doesn’t hurt that some pay a healthy dividend as well!

April 6, 2022 | Daily JAM |

Oil fell to the lowest level since mid-March today, April 6, after the International Energy Agency said its members will release an additional 60 million barrels of oil from emergency reserves

March 31, 2022 | Daily JAM, Morning Briefing, Short Term |

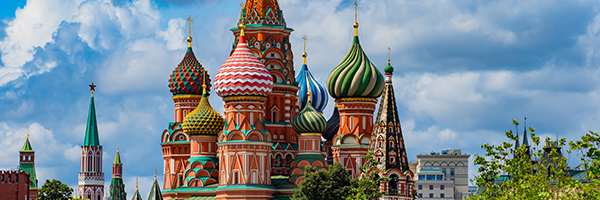

Today, March 31, OPEC+, which includes Russia, decided to stick with their previously agreed plan of modest monthly increases. Despite repeated asks from Washington and European countries to increase production in order to make up for shortfalls from Russia due to Western sanctions on that country as a result of its invasion of Ukraine, OPEC+ said it would increase oil output in May by 432,000 barrels a day, a slight uptick from the agreed increase of 400,000 barrels a day. The small increase–essentially no increase at all–would be for “technical reasons.” OPEC+ repeated its outlook for a month ago saying that the outlook was for “a well-balanced market” and that recent volatility in prices was “not caused by fundamentals, but by ongoing geopolitical developments.” Well, yeah. And isn’t that the point?

March 30, 2022 | Daily JAM, Morning Briefing, Short Term |

Hopes for a cease fire in Ukraine and for serious peace talks between Russia and Ukraine took the stock indexes up yesterday and the price of oil and oil stocks down. News of renewed Russian shelling today took the market back down and oil and oil stocks back up today.

March 28, 2022 | COP, Daily JAM, EQNR, Jubak Picks, LNG, Videos, Volatility |

Don’t sell those oil stocks yet! Back at the beginning of the year, I anticipated that coming conflict between Russia and the Ukraine would drive up the price of oil, and the stocks I added to my portfoliohene stocks (COP, EQNR, LNG) have all been up big. But, I don’t think it’s time to sell yet. Why? Summer. Summer is the big driving season in the Northern Hemisphere, and right now (in what’s called the “shoulder season”) reserves of gasoline are supposed to be replenished in anticipation of summer. But that’s not happening due to Russia-Ukraine, and I think with summer we will see prices for oil spike even higher. That’s why I wouldn’t sell these stocks yet. (And that’s despite of the selling today, March 28, on more lockdowns in China)

March 23, 2022 | COP, Daily JAM, EQNR, Jubak Picks, LNG, PXD, Volatility |

Oil rallied again today with U.S. benchmark West Texas Intermediate up 4.79% on the day to $114.79 a barrel and international benchmark Brent up 5.12% to $121.39 a barrel. So, natural, oil and gas equities stocks are up today. And the broader market is down. What else isn’t new?

March 15, 2022 | Daily JAM, Jubak Picks, Morning Briefing |

Oil prices collapsed. And airlines reported better than expected pick up in traffic. So airline stocks soared with the most stressed operators showing the biggest gains in their shares. Delta Air Lines (DAL) closed up 8.70% on the day. United Airlines (ULA) picked up 9.19%. And American Airlines (AAL) gained 9.26%.

March 8, 2022 | ALB, CHPT, COP, Daily JAM, DNNGY, EVGO, Morning Briefing, PXD |

The United States will ban imports of oil and natural gas from Russia, President Biden announced Tuesday. U.S. allies in Europe also announced action on the energy front with a plan to cut natural gas imports from Russia by two-thirds in 2022. Even though the White House has said that the long-lead time on the ban would give importers and consumers time to find other sources by the end of 2022, oil futures soared today with the price of West Texas Intermediate, the U.S. crude benchmark, climbing to $126.98 a barrel, up 6.35%, for April delivery as of 12:30 p.m. in New York. International benchmark Brent creek rose 6.52%to $131.24 a barrel for April delivery.

March 7, 2022 | COP, Daily JAM, EQNR, Jubak Picks, LNG, Morning Briefing, PXD, Top 50 Stocks |

I suppose there is something else that could add to the supply of bad news today on oil supply, but we’ve already got a full dance card At 2 P.m. in New York U.S. crude benchmark West Texas Intermediate traded up 5.07% to $121.55 a barrel; international benchmark Brent crude was up 6.24% to $125.48 a barrel. Where to start?

March 4, 2022 | Daily JAM, DAL, Jubak Picks |

As far as I’ve been able to discover, it was a research note from Wolfe Research that began the negative “rethink.” Wolfe forecast that the airlines including United Airlines (UAL) and American Airlines (AAL) were burning cash so fast because of the jump in the cost of jet fuel that they might need to sell stock to secure more liquidity.. The worry isn’t outlandish. Oil broke above $115 a barrel (for U.S. West Texas Intermediate) today and JPMorgan Chase and Goldman Sachs have both recently projected that crude could rise to $185 a barrel by the end of 2022. Today shares of American Airlines (AA) were off 7.13%. United Airlines (UAL) dropped 9.07%. And Delta Air Lines (DAL) was down 5.63%.

February 27, 2022 | COP, Daily JAM, DAL, EQNR, Jubak Picks, LNG, PXD, Volatility |

On Saturday the European Union nations that control SWIFT, the dominant global network connecting banks, announced that they would expel some specific Russian banks from the network. The U.S., Canada, and the United Kingdom agreed with the move. The U.S. and its European allies left open the question of sanctions directly on Russia’s central bank.

The move to deny access to SWIFT means that the named Russian banks, and I’m not naming them because I haven’t been able to find a list, won’t be able to pay other banks or receive funds from other banks. They will not be able to transact business with international banks over the SWIFT network for their client businesses. I’d expect that out of an abundance of understandable caution, many Western banks will refuse to do business with Russian banks at all.